December 2023 was a month where buyers and sellers were paying close attention to what was happening with mortgage interest rates. November 2023 delivered us the first big break in interest rates as we finally saw them start to tumble from the highs of 8%. Many buyers and sellers were very tentative about whether these drops would last and there was fantastic news that the Federal Reserve delivered at its meeting in December. They discussed not raising the rates that end up affecting mortgage rates and they went further indicating that cuts could start coming in 2024.

All of this good news led to mortgage applications increasing at a rapid rate. Many indications both personally and from my team at Pemberton Homes is that buyers who had been on the sidelines now started looking in earnest again. You can start to see this in the increase in showing activity. For the month of December we saw a 7.7% increase in showing activity compared to December 2022. I would expect that to continue because the Minneapolis Association of Realtors® is also showing that showings are up 29.9% for the week ending January 7, 2024 compared to the same week last year. This is a huge increase!

The average days on market for a listing to go from active to pending was 50 days. This sounds like a long time but this is where really looking into the numbers and pulling the data apart is important. The winter months traditionally means a house will take longer to sell. When we zoom out and look at December of 2018 and 2019 we see that the average time for a house to sell was 57 and 56 days respectively so 50 days is really right in line with where we might hope to be in a “normal” market.

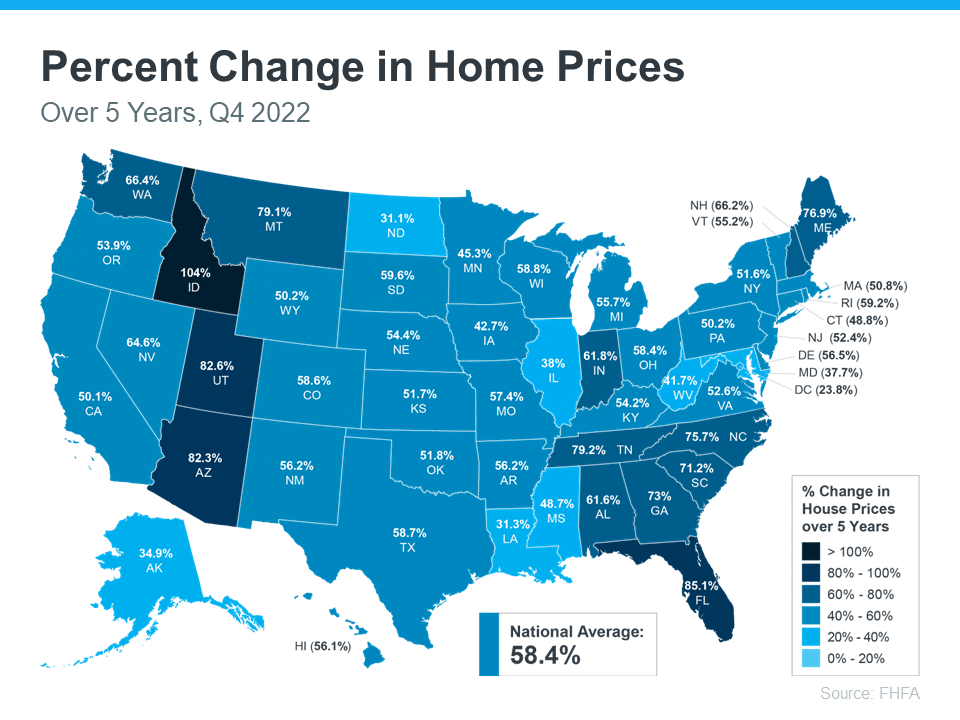

We haven’t seen a drop in the sales price of homes in our market. Homes aren’t appreciating at the rate they were in previous years but they are still appreciating.

What I Expect Going Forward

There are numerous sellers who have been waiting to sell. I expect with interest rates leveling off, the start of the spring market, and sellers starting to feel impatient from having to wait that new listings will continue to increase and outpace last years numbers.

Even though we will see new listings increase that doesn’t mean that the available inventory of homes will increase. Most sellers are buyers and just like sellers were waiting on interest rates to sell, buyers were waiting on interest rates to fall to enter the market.

I would expect that the days on market to sell a house will continue to increase in January and February. When we look at historical trends January and February typically continue to increase in average days on the market. The one thing that could change this is a bunch of buyers jumping into the market to get a head start so they don’t have to compete with the rush of spring market buyers.