If you’re planning to buy or sell a home in 2025, there’s a key trend you need to know: buyers and sellers aren’t seeing eye to eye on price. A recent Clever Real Estate survey revealed a $27,000 gap between what buyers expect to pay and what sellers hope to get. Buyers are budgeting around $386,507, while sellers are aiming for $413,976.

So, what’s driving this pricing gap, and how can you navigate it? Let’s break it down.

What’s Behind the $27,000 Pricing Gap?

Sellers Are Riding High on Confidence

After years of rising home prices, sellers are entering 2025 with optimism. In fact, 74% of sellers believe they’ll sell at or above asking price. However, with market conditions stabilizing, these high expectations may not always align with buyer budgets.

Buyers Are Feeling the Pinch

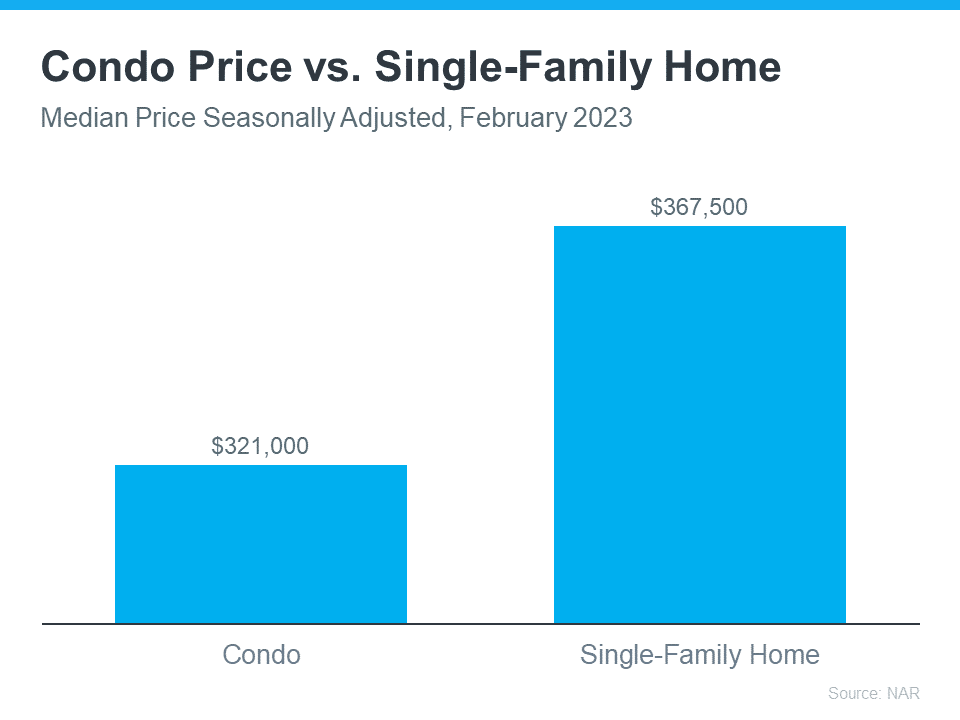

On the flip side, buyers are grappling with rising mortgage rates and affordability challenges. Nearly 68% worry escalating prices will delay their purchase plans. Budget constraints often lead to tougher negotiations or missed opportunities.

Shifting Market Trends

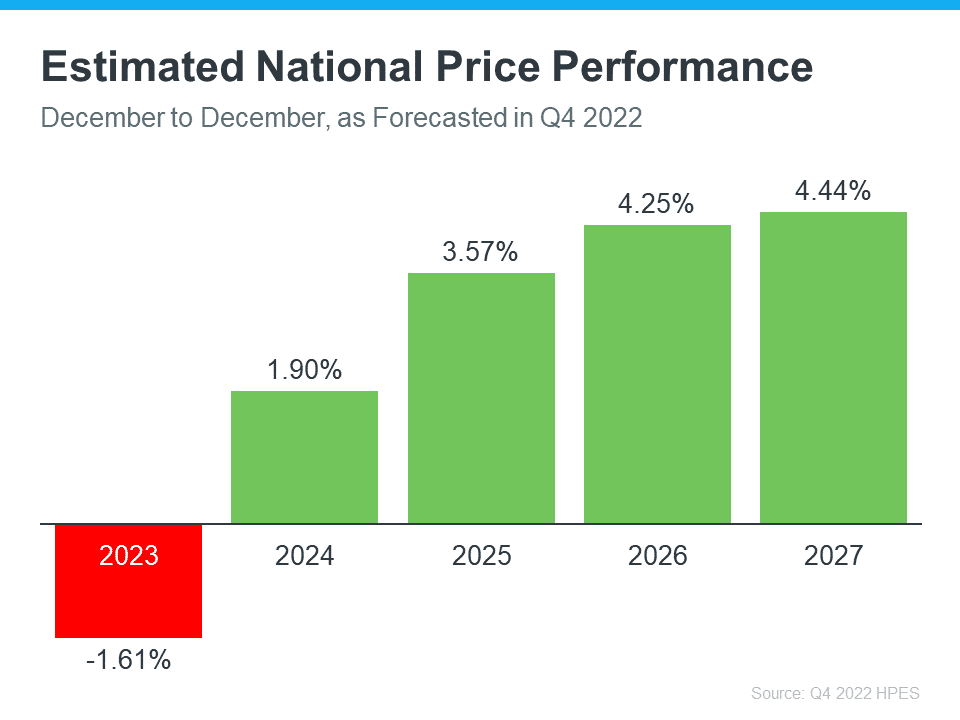

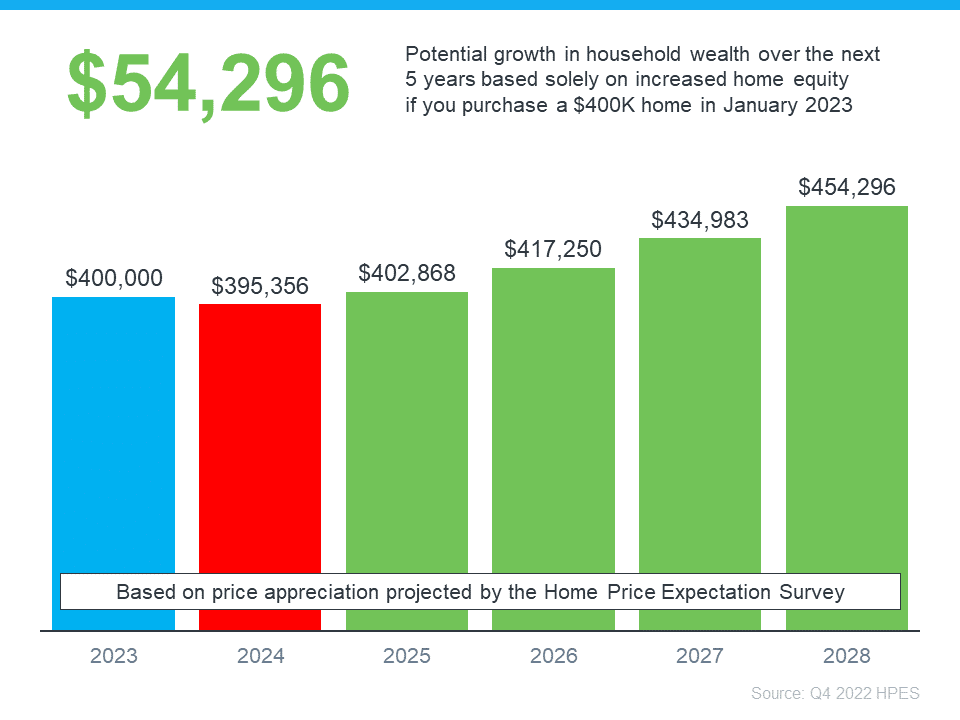

While 87% of buyers and sellers expect strong demand in 2025, housing economists predict smaller price increases compared to previous years. This stabilization could mean buyers have more negotiating power, while sellers might need to rethink pricing strategies.

Tips for Buyers: How to Bridge the Gap

Navigating the $27,000 gap can feel overwhelming, but these strategies can help:

- Know Your Market: Research local home prices and trends. Being informed gives you an edge in negotiations.

- Be Flexible: If you can’t meet the asking price, consider other ways to sweeten your offer, like flexible closing dates or waived contingencies.

- Leverage Stabilizing Prices: Slower price growth in 2025 could work in your favor during negotiations.

Tips for Sellers: Attracting the Right Offers

Sellers, getting top dollar means setting realistic expectations and preparing your home to shine. Here’s how:

- Price Strategically: Partner with a local real estate expert to price your home competitively. Nearly 49% of agents agree pricing is the key to a quick sale.

- Stage Your Home: Professional staging or high-quality photos can help justify your asking price.

- Stay Open to Negotiations: Flexibility can mean the difference between a quick sale and a prolonged listing.

What the Pricing Gap Means for the 2025 Real Estate Market

The $27,000 pricing gap highlights a broader trend in the housing market: cautious buyers versus confident sellers. Bridging this gap will require both sides to adjust their expectations. For buyers, it’s about realistic budgeting and smart negotiations. For sellers, it’s understanding market trends and pricing your property to attract serious offers.

With the right strategies and a little compromise, 2025 could be a great year for both buyers and sellers.

TL;DR

- Buyers expect to spend $386,507, while sellers aim for $413,976—a $27,000 pricing gap.

- Sellers are confident, but buyers are cautious due to rising costs and mortgage rates.

- Strategic planning and realistic expectations are key for navigating the 2025 real estate market.

Are you ready to tackle the 2025 housing market? Let’s work together to achieve your goals!